Depreciation percentage on equipment

Therefore it must also use the same approach to calculate the depreciation on these computers. Tax software will make this calculation automatically as the tax return is preparedTable A-1 above provides percentages to calculate the annual depreciation over a.

Depreciation Schedule Formula And Calculator Excel Template

Also known as a Percentage Depreciation Calculator the Declining Balance Depreciation Calculator provides visability of a declining balance depreciation is where an asset loses.

. It is a method of distributing the cost evenly across the useful life of the asset. The Modified Accelerated Cost Recovery System MACRS allows you to take a bigger deduction for depreciation on medical equipment for the early years in the life of an. 170 rows Class of assets.

For example if you have. Not Book Value Scrap value. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam.

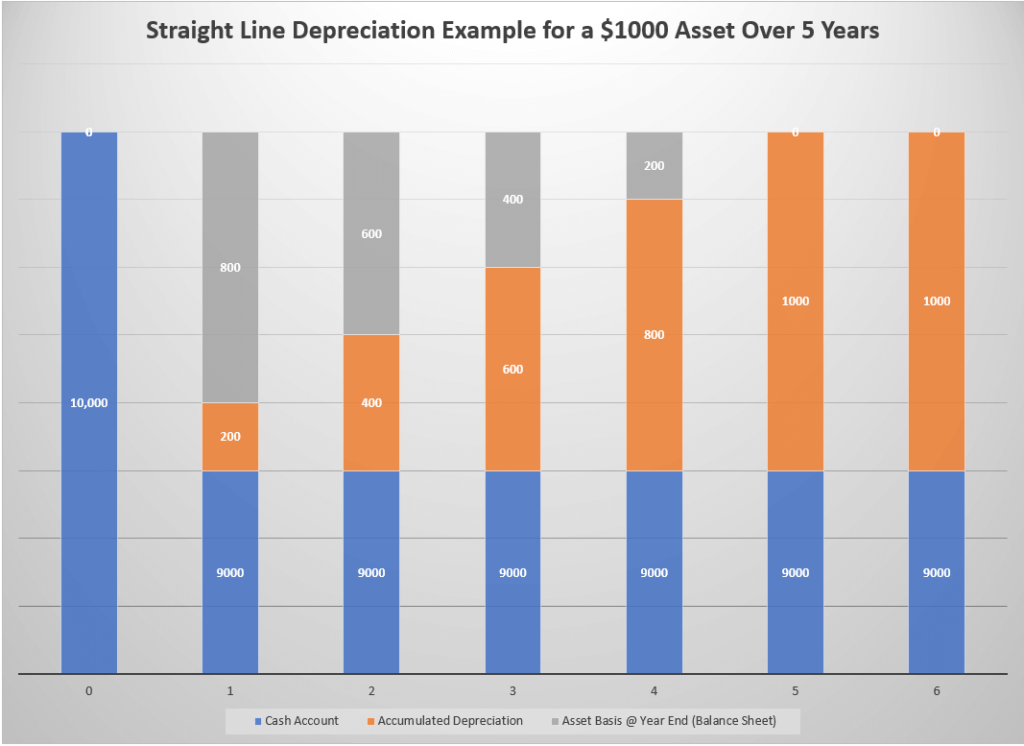

The formula for calculating the depreciation rate is. Straight-line depreciation is the most widely used and simplest method. 18000 for the first year 16000 for the second year 9600 for the third year.

In order to calculate the depreciation expense we multiply the depreciable amount cost scrap value with the depreciation rate. Divide the balance by the number of years in the useful life. Percentage Declining Balance Depreciation Calculator.

Calculate his annual depreciation expense for the year ended 2019. The formula to calculate depreciation through the double-declining method is. We also list most of the classes and rates at CCA classes.

This gives you the. The balance is the total depreciation you can take over the useful life of the equipment. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Cost of machine 10000 Scrap value of machine 1000 Machines estimated useful life 5 years Annual Depreciation Cost of Asset Net Scrap ValueUseful Life. If a taxpayer claims 100 percent bonus depreciation the greatest allowable depreciation deduction is. Class 1 4 Class 3 5.

Below we present the more common classes of depreciable properties and their rates. Calculates the office equipment depreciation for the computers as. The following is the formula.

Depreciation On Equipment Definition Calculation Examples

Depreciation Nonprofit Accounting Basics

Depreciation Rate For Plant Furniture And Machinery

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

What Is Equipment Depreciation And How To Calculate It

Depreciation Rate Formula Examples How To Calculate

Accelerated Depreciation And Machinery Purchases Center For Commercial Agriculture

How To Calculate Depreciation Expense

Depreciation Nonprofit Accounting Basics

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Rate Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

What Is Equipment Depreciation And How To Calculate It